pet health insurance seattle: a practical field guide for city pet owners

I've been walking this city with a curious eye - from Queen Anne stairways to Rainier Beach parks - trying to understand how policies actually behave once fur, rain, and real life get involved. Not theory. Practical moves that make care accessible and reliable when you need it fast.

What coverage means in a Seattle context

Specialty hospitals, late-night emergencies, and weekend trail mishaps around Tiger Mountain or Discovery Park can add up. Coverage isn't simply a cushion; it's a way to keep choices open, especially when the ER lobby is full and the estimate is higher than you expected.

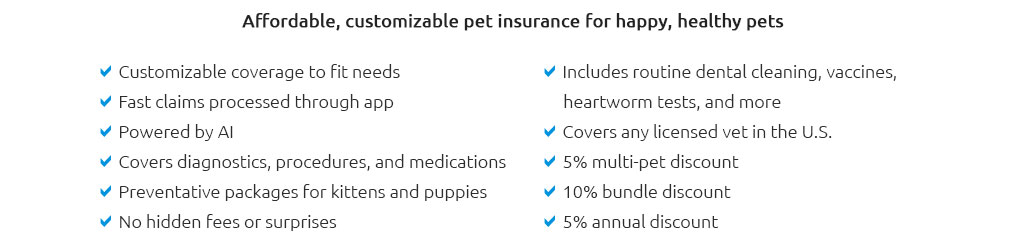

- Accident care: swallowed socks, sprains from slick sidewalks, porcupine quills on a mountain detour.

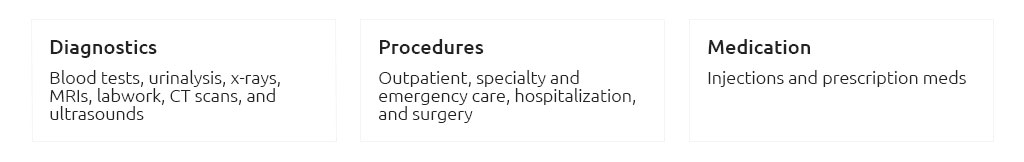

- Illness care: diagnostics, hospitalization, chronic conditions that don't fit into a neat weekend timeline.

- Prescription meds and rehab: often covered, sometimes limited; read caps closely.

- Tele-vet and 24/7 nurse lines: small feature, big relief at 1 a.m. when you'd rather not drive to SoDo.

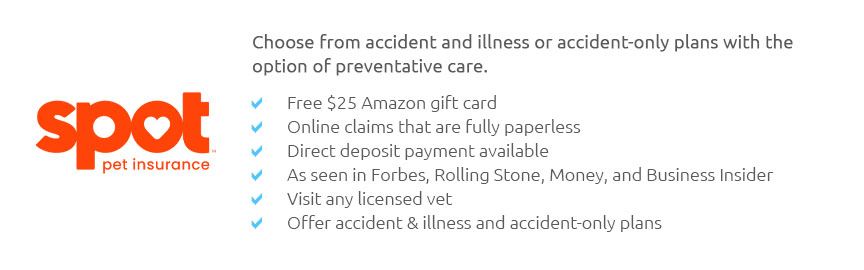

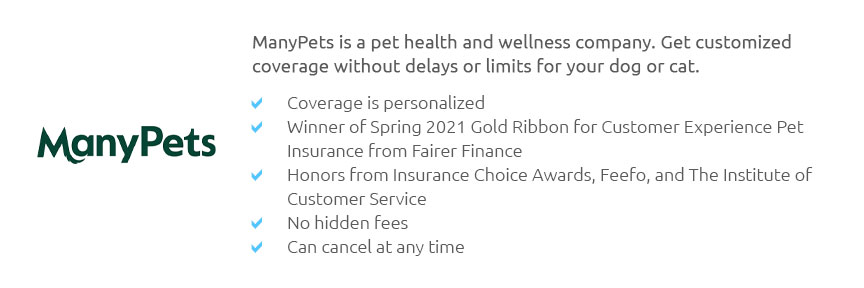

Plans in plain language

You don't need to memorize policy jargon. Actually, a few terms do matter because they change your bill today and next year.

- Accident-only: least expensive, covers injuries but not illnesses.

- Accident + illness: the core pick for most urban pets; watch for hereditary condition rules.

- Wellness add-ons: vaccines and annual exams; helpful if you prefer predictable budgets, optional if you pay routine care out-of-pocket.

- Deductible: annual is simpler than per-incident for city life with frequent little issues.

- Reimbursement: 70 - 90% is common; higher isn't always "better" if it squeezes your monthly budget.

Costs and tradeoffs you can feel

Roughly, Seattle dogs often land near mid-to-high premiums; cats trend lower. Age and breed matter more than your zip code - though local costs nudge things. I used to think the premium was the whole story; correction: annual limits and exclusions decide how a tough year plays out.

- Premium drivers: age, breed risk, deductible, reimbursement rate, and annual cap.

- Common ranges: dogs can hover from moderate to pricey; cats usually sit modestly below. Adjusting deductible by a notch can calm the monthly hit.

- Accessibility note: look for flexible deductibles and no-fee monthly billing; small details keep coverage attainable.

A small, real-world Seattle moment

Rain pattered on Green Lake. My terrier misjudged a slick corner, and the ER estimate made my stomach drop. I snapped a photo of the paperwork, uploaded it from the parking lot, and we went ahead with care. Four days later, 80% of the bill landed back in my account. Not dramatic - just steady, dependable support.

How to choose without getting lost

- List your must-haves: chronic conditions covered, no lifetime caps, and an annual deductible you can actually meet.

- Call your regular vet; ask which insurers are easiest to work with for direct pay or quick claim forms.

- Gather three quotes with the same deductible, reimbursement, and cap so comparisons are fair.

- Skim the exclusions: waiting periods, dental illness rules, and exam requirements.

- Check customer support hours that match Pacific Time - reliability includes human help.

Exploring a couple of options is fine; just pause long enough to read the limits. The only thing that truly rewards speed is the waiting period clock - starting sooner shortens the gap before full coverage.

Claims, timelines, and small-but-critical details

- Waiting periods: accidents often 2 - 5 days, illnesses longer; orthopedic issues can have extra rules for some breeds.

- Documentation: a recent exam record smooths approvals; keep PDFs from your clinic portal.

- Reimbursement speed: a few days to a couple of weeks is typical; direct pay is rare but growing - ask your ER in advance.

Pre-existing conditions are generally not covered, and that's consistent across providers. It's not ideal, but it's transparent - reliability sometimes means clear boundaries.

Local-friendly habits that make care accessible

- Save an emergency fund equal to your deductible; it turns a bad night into a manageable paperwork process.

- Confirm 24/7 contact options; even a basic nurse line can prevent an unnecessary midnight drive.

- Keep a glovebox folder with vaccination records and prior invoices; traffic on I-5 is enough stress already.

- If you split time between Seattle and the Eastside, verify coverage across clinics; multi-facility flexibility matters.

I started this search expecting glossy promises. What I found was simpler: choose a plan that pays consistently, explains denials plainly, and lets you say "yes" to care without a scramble. That's accessibility. That's reliability. And around here, that's peace of mind - rain or shine.